Sullivan County Tn Property Tax Calculator . Property tax information last updated: The county’s average effective property tax rate is 0.73%, while the state average is 0.56%. Northeast tennessee’s sullivan county has property tax rates just below the state average. Property tax information last updated: how to calculate your tax bill. Our tennessee property tax calculator can estimate your property taxes based on similar. Property taxes in tennessee are calculated utilizing the following four components: Pay your county property taxes here. You may begin by choosing a search. our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Homeowners in washington county pay a median property tax of just $1,215 annually. 501 rows tennessee trustee. pay county property taxes. the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within.

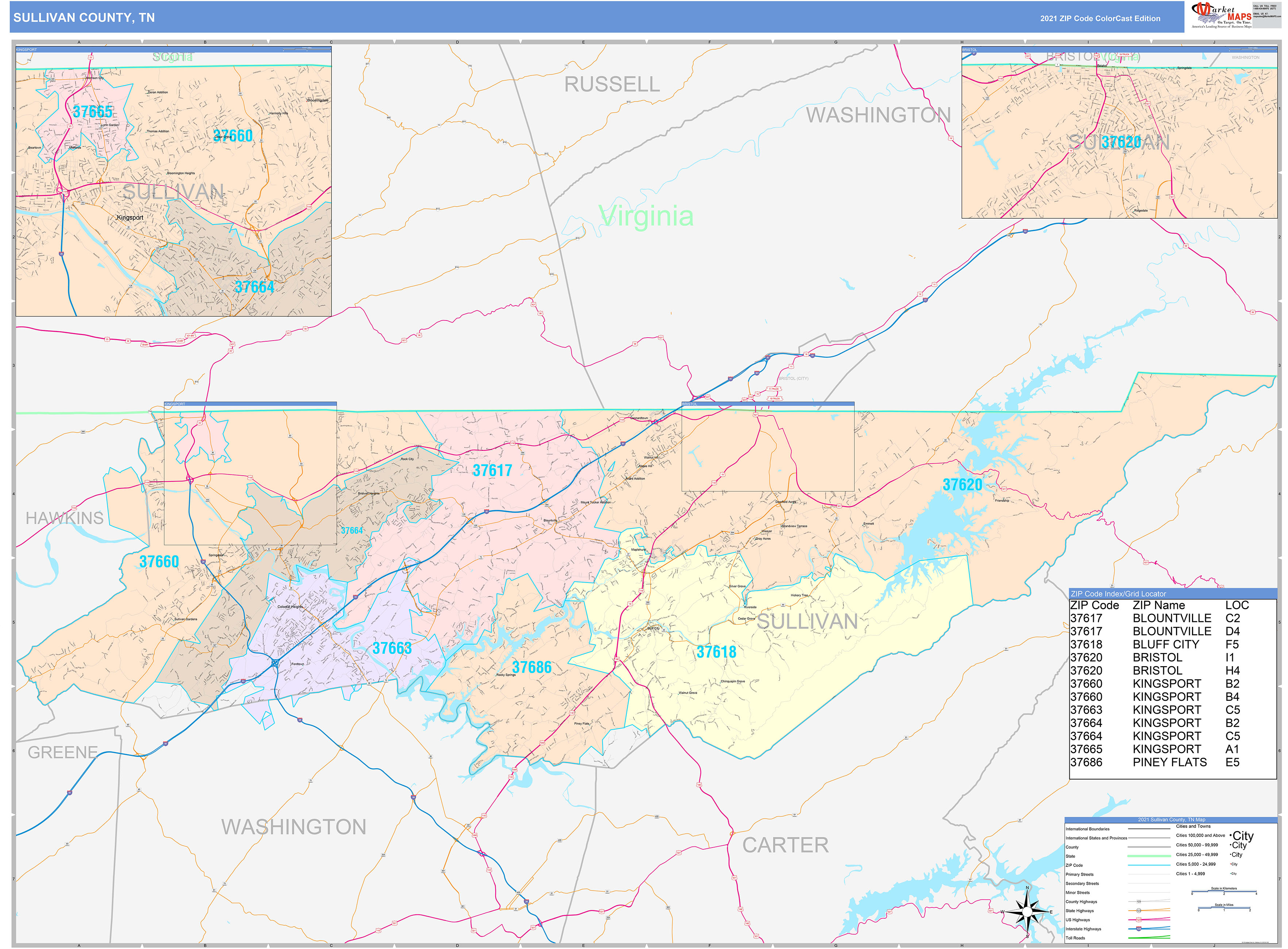

from www.mapsales.com

Property tax information last updated: Property tax information last updated: Our tennessee property tax calculator can estimate your property taxes based on similar. Property taxes in tennessee are calculated utilizing the following four components: Northeast tennessee’s sullivan county has property tax rates just below the state average. our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. how to calculate your tax bill. Homeowners in washington county pay a median property tax of just $1,215 annually. The county’s average effective property tax rate is 0.73%, while the state average is 0.56%.

Sullivan County, TN Wall Map Color Cast Style by MarketMAPS MapSales

Sullivan County Tn Property Tax Calculator pay county property taxes. our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Northeast tennessee’s sullivan county has property tax rates just below the state average. the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. Property taxes in tennessee are calculated utilizing the following four components: Property tax information last updated: Our tennessee property tax calculator can estimate your property taxes based on similar. how to calculate your tax bill. 501 rows tennessee trustee. Pay your county property taxes here. Property tax information last updated: The county’s average effective property tax rate is 0.73%, while the state average is 0.56%. pay county property taxes. You may begin by choosing a search. Homeowners in washington county pay a median property tax of just $1,215 annually.

From www.icsl.edu.gr

How To Calculate Property Tax In Texas Sullivan County Tn Property Tax Calculator The county’s average effective property tax rate is 0.73%, while the state average is 0.56%. You may begin by choosing a search. how to calculate your tax bill. Property tax information last updated: Pay your county property taxes here. our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how. Sullivan County Tn Property Tax Calculator.

From exospmybd.blob.core.windows.net

Sullivan County Tn Real Estate Taxes at Brian Robinson blog Sullivan County Tn Property Tax Calculator Property tax information last updated: Homeowners in washington county pay a median property tax of just $1,215 annually. Property taxes in tennessee are calculated utilizing the following four components: the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. how to calculate your tax bill. Our tennessee. Sullivan County Tn Property Tax Calculator.

From myviewfromthewoods.com

The Tennessee Counties with the Lowest Property Tax Rates Sullivan County Tn Property Tax Calculator Our tennessee property tax calculator can estimate your property taxes based on similar. You may begin by choosing a search. our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Northeast tennessee’s sullivan county has property tax rates just below the state average. Pay your county property taxes here.. Sullivan County Tn Property Tax Calculator.

From southerngenealogybooks.com

Sullivan County, Tennessee 1836 Civil Districts and 1837 Tax List Sullivan County Tn Property Tax Calculator 501 rows tennessee trustee. Property taxes in tennessee are calculated utilizing the following four components: Property tax information last updated: our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Pay your county property taxes here. The county’s average effective property tax rate is 0.73%, while the state. Sullivan County Tn Property Tax Calculator.

From www.buyu783.com

A Impact a Directions the that Application off Medsurg Capabilities Sullivan County Tn Property Tax Calculator Property tax information last updated: 501 rows tennessee trustee. Our tennessee property tax calculator can estimate your property taxes based on similar. Pay your county property taxes here. Northeast tennessee’s sullivan county has property tax rates just below the state average. how to calculate your tax bill. You may begin by choosing a search. pay county property. Sullivan County Tn Property Tax Calculator.

From www.wjhl.com

Sullivan County Commission approves budget with 2cent tax increase Sullivan County Tn Property Tax Calculator 501 rows tennessee trustee. Pay your county property taxes here. the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. Homeowners in washington county pay a median property tax of just $1,215 annually. how to calculate your tax bill. Northeast tennessee’s sullivan county has property tax. Sullivan County Tn Property Tax Calculator.

From exospmybd.blob.core.windows.net

Sullivan County Tn Real Estate Taxes at Brian Robinson blog Sullivan County Tn Property Tax Calculator Property taxes in tennessee are calculated utilizing the following four components: Property tax information last updated: our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how your. how to calculate your tax bill. 501 rows tennessee trustee. the primary responsibility of the assessor of property is to. Sullivan County Tn Property Tax Calculator.

From dxozjqsvt.blob.core.windows.net

Property Tax Cleveland Tn at Elly Walls blog Sullivan County Tn Property Tax Calculator Pay your county property taxes here. The county’s average effective property tax rate is 0.73%, while the state average is 0.56%. how to calculate your tax bill. Property tax information last updated: Our tennessee property tax calculator can estimate your property taxes based on similar. Property taxes in tennessee are calculated utilizing the following four components: 501 rows. Sullivan County Tn Property Tax Calculator.

From exospmybd.blob.core.windows.net

Sullivan County Tn Real Estate Taxes at Brian Robinson blog Sullivan County Tn Property Tax Calculator Our tennessee property tax calculator can estimate your property taxes based on similar. You may begin by choosing a search. how to calculate your tax bill. Property tax information last updated: Property tax information last updated: 501 rows tennessee trustee. our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show. Sullivan County Tn Property Tax Calculator.

From www.atlasbig.com

Tennessee Sullivan County Sullivan County Tn Property Tax Calculator Homeowners in washington county pay a median property tax of just $1,215 annually. the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. pay county property taxes. how to calculate your tax bill. The county’s average effective property tax rate is 0.73%, while the state average. Sullivan County Tn Property Tax Calculator.

From malekproperties.com

Sullivan County Sullivan County Tn Property Tax Calculator You may begin by choosing a search. the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Property tax information last updated: Pay your county property taxes. Sullivan County Tn Property Tax Calculator.

From www.youtube.com

Property Tax Calculations and Prorations Math Worksheet YouTube Sullivan County Tn Property Tax Calculator Property tax information last updated: how to calculate your tax bill. pay county property taxes. Northeast tennessee’s sullivan county has property tax rates just below the state average. Property taxes in tennessee are calculated utilizing the following four components: Pay your county property taxes here. 501 rows tennessee trustee. Property tax information last updated: The county’s average. Sullivan County Tn Property Tax Calculator.

From www.niche.com

2023 Safe Places to Live in Sullivan County, TN Niche Sullivan County Tn Property Tax Calculator Northeast tennessee’s sullivan county has property tax rates just below the state average. pay county property taxes. the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. Pay your county property taxes here. Property tax information last updated: our sullivan county property tax calculator can estimate. Sullivan County Tn Property Tax Calculator.

From rethority.com

Property Tax by County & Property Tax Calculator REthority Sullivan County Tn Property Tax Calculator Homeowners in washington county pay a median property tax of just $1,215 annually. 501 rows tennessee trustee. Property tax information last updated: the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. our sullivan county property tax calculator can estimate your property taxes based on similar. Sullivan County Tn Property Tax Calculator.

From cekebwef.blob.core.windows.net

Tennessee Property Tax Rate Calculator at Michelle Martinez blog Sullivan County Tn Property Tax Calculator the primary responsibility of the assessor of property is to discover, list, classify and value all real and personal property within. Homeowners in washington county pay a median property tax of just $1,215 annually. Property tax information last updated: The county’s average effective property tax rate is 0.73%, while the state average is 0.56%. our sullivan county property. Sullivan County Tn Property Tax Calculator.

From www.wikihow.com

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow Sullivan County Tn Property Tax Calculator The county’s average effective property tax rate is 0.73%, while the state average is 0.56%. Northeast tennessee’s sullivan county has property tax rates just below the state average. Our tennessee property tax calculator can estimate your property taxes based on similar. pay county property taxes. Property taxes in tennessee are calculated utilizing the following four components: our sullivan. Sullivan County Tn Property Tax Calculator.

From www.financestrategists.com

Find the Best Tax Preparation Services in Sullivan County, TN Sullivan County Tn Property Tax Calculator Our tennessee property tax calculator can estimate your property taxes based on similar. 501 rows tennessee trustee. Homeowners in washington county pay a median property tax of just $1,215 annually. The county’s average effective property tax rate is 0.73%, while the state average is 0.56%. Northeast tennessee’s sullivan county has property tax rates just below the state average. . Sullivan County Tn Property Tax Calculator.

From www.ownerly.com

How to Calculate Property Tax Ownerly Sullivan County Tn Property Tax Calculator Property taxes in tennessee are calculated utilizing the following four components: Pay your county property taxes here. pay county property taxes. Northeast tennessee’s sullivan county has property tax rates just below the state average. our sullivan county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Property tax information last. Sullivan County Tn Property Tax Calculator.